Technical Analysis

is the study of price movements using charts and indicators.

Traders use tools like RSI, MACD, trend lines, and candlestick patterns to forecast potential price behavior.

or in other ways Technical analysis for trading studies the price of an asset such as a f

orex pair using historical price charts and market statistics. It is rooted in the notion that if you can identify previous market patterns,

you can form a fairly accurate prediction of future price action.

2. Trend In Terms of Technical Analysis

Trend represents one of the most essential concepts in technical analysis. All the tools that an analyst uses have a single purpose: help to identify the market trend. The expressions like “trend is your friend” or “Never buck the trend” are not used accidentally. The meaning they contain is more than deeper. So, it is worth properly understanding what the trend is and what type of trend is possible to differentiate.

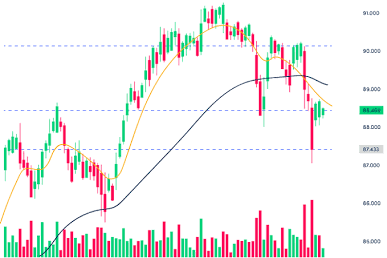

3. Chart Construction

In technical analysis a chart is a graphical representation of price movements over a certain time frame. It can show security’s price movement over a month or a year period.

4. Technical Indicators

Technical indicators are calculations which are based on the price and volume of a security. They are used both to confirm the trend and the quality of chart patterns, and to help traders determine the buy and sell signals.

Indicators are used to identify trends, volatility, momentum and other aspects in a security to help in the trend’s technical analysis. They can be applied separately to form buy and sell signals, as well as can be used together, in conjunction with chart patterns and price movement.

Forex Technical Analysis PD

In the technical analysis forex book you will be learning, technical analysis is a method used to study market action, primarily through the use of charts, to forecast future price trends. The primary sources of information used in technical analysis are price, market volume, and open interest in options and futures. It is based on three fundamental premises:

Market action discounts everything: Technical analysts believe that all relevant information affecting the price of a market is already reflected in its price. The forces of supply and demand, as well as fundamental, political, economic, and psychological factors, are all represented in the market price.

Price moves in trends: Technical analysis assumes that once a trend is established, it is more likely to continue in the same direction than to reverse. The goal of technical analysis is to identify trends early on and trade in the direction of those trends.

History repeats itself: This premise suggests that past price movements and chart patterns tend to repeat in the future due to human psychology and market participants' behavior. Certain chart patterns are used to analyze market movements and predict future price movements.

Technical analysis is different from fundamental analysis, which focuses on studying the underlying factors that influence market direction. Fundamentalists try to understand the "why" behind price movements, while technicians focus on the "what" by studying price patterns and technical indicator