What is fundamental analysis in trading?

There are many different types of investing analysis. Fundamental analysis is one method and can be understood as a process used to assess an instrument’s strength over a period of time and into the future. This could include examining related economic and financial factors such as a country’s interest rate, inflation, microeconomic indicators, and consumer behavior. It could also include news from political exposées and events caused by extreme weather, such as drought and floods. Traders who use fundamental analysis of forex and cryptocurrencies in their trading strategy are looking for catalysts that signal a sudden jump in demand of an asset, either strengthening a trend or bringing about a reversal or breakout.the difference between fundamental and technical analysis

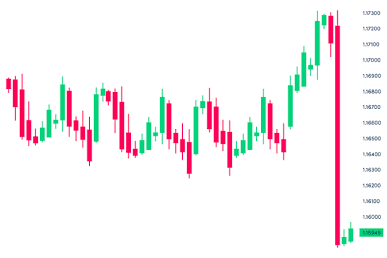

Traders who trade ‘the technicals’ using technical analysis ﹣ are essentially trading what they see on their charts. They will use indicators, volume and various other tools available to them from a trading platform to identify potentially smart entry and exit points for a trade idea. Some traders prefer only to trade the technicals ﹣ they may refer to fundamentals and news as ‘noise’. For them, the chart tells them all that they need to know about an instrument’s direction in the market. Similarly, some traders who prefer fundamental analysis will only trade off big decisions made by banks and governments or events stemming from natural disasters.

practice quiz

Quiz 1: What type of news is important for fundamental analysis?

Quiz 2: What is fundamental analysis used for in Forex?

Quiz 3: Why do traders follow employment data?